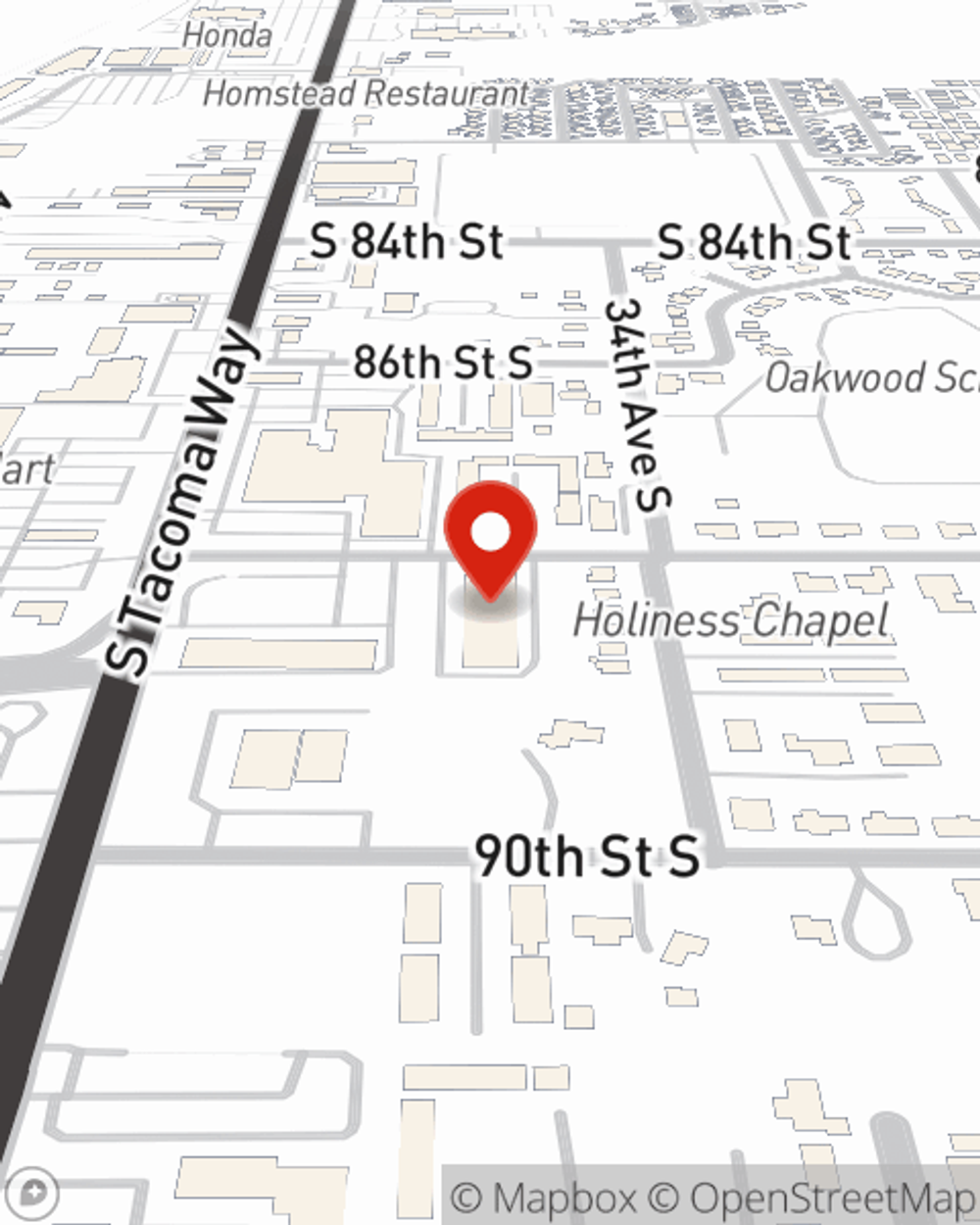

Life Insurance in and around Lakewood

Coverage for your loved ones' sake

Life happens. Don't wait.

Would you like to create a personalized life quote?

- Seattle

- Spokane

- Tacoma

- Lakewood

- Vancouver

- Olympia

- Puyallup

- South Hill

- Spanaway

- Auburn

- Kent

- Bellevue

- Redmond

- Richland

- Federal Way

- King County

- Pierce County

- Snohomish County

- Spokane County

- Clark County

- Thurston County

- Kitsap County

- Yakima County

- Whatcom County

Check Out Life Insurance Options With State Farm

Purchasing life insurance coverage can be a lot to ponder with several different options out there, but with State Farm, you can be sure to receive dependable considerate service. State Farm understands that your ultimate goal is to protect your family.

Coverage for your loved ones' sake

Life happens. Don't wait.

Life Insurance Options To Fit Your Needs

When choosing how much coverage is right for you, it's helpful to know the factors that play into the type and amount of Life insurance you need. These tend to be things like the age you are now, your physical health, and perhaps even personal medical history and occupation. With State Farm agent Kao Xiong, you can be sure to get personalized service depending on your unique situation and needs.

To learn more about your Life insurance options with State Farm, call or email Kao Xiong's office today!

Have More Questions About Life Insurance?

Call Kao at (253) 212-3147 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Simple Insights®

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.